Saint Johns, Florida financial advisor Kendal Cann (CRD# 6504618) allegedly recommended unsuitable investments, according to a recent investor complaint. Financial...

Read MoreFIRST ANNUAL STUDY: THE 2023 STATE OF INVESTMENT FRAUD

See Which Americans are Most At-Risk After a Record $3.82 Billion was Stolen in 2022

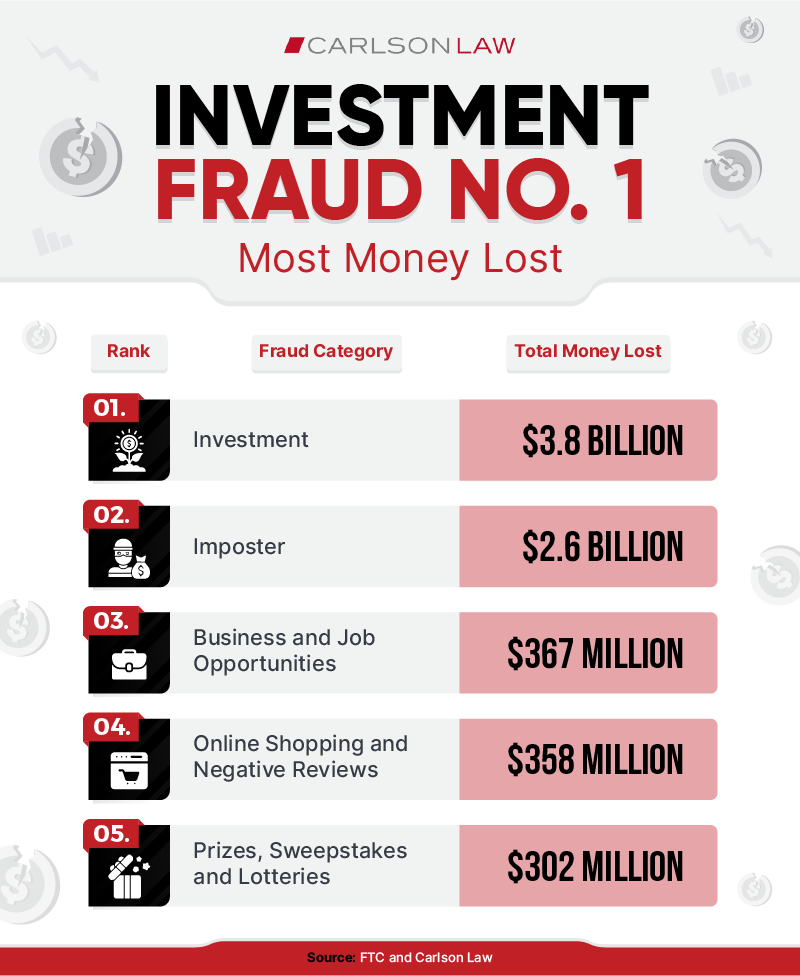

In 2022, Americans lost more money to investment fraud than any other type of fraud. According to the Federal Trade Commission (FTC), there was a record $3.82 billion stolen through investment fraud in 2022, which was a 128% increase from $1.67 billion in 2021.

The unprecedented rise in investment fraud is due to a combination of traditional and modern tactics, with the bulk of the increase coming from cryptocurrency-related scams. In 2022, a record $2.57 billion was lost to crypto-investment scams. Traditional scams, including Ponzi schemes (such as Bernie Madoff’s $64 billion fraud), pyramid scams, and real estate fraud, were also prevalent.

Fraudsters are also exploiting advances in technology. Many of these news scams utilize artificial intelligence, such as voice cloning, and have law enforcement scrambling to keep pace.

Despite the increase in overall investment fraud, the number of claims against financial advisors that included allegations of fraud fell from 744 in 2021 to 699 in 2022, according to data released by The Financial Industry Regulatory Authority.

This alarming trend impacts Americans from all levels of society. Ernst & Young published a study based on legal proceedings from 2004 to 2018, which found that professional athletes—including the NFL, NBA, MLB and NHL—lost $585 million to investment scams. The average American often works their entire life to accrue savings and faces devastation after investment fraud. While all age groups can be targeted, ages 30 to 49 are the most targeted for investment scams, according to the FBI. However, less tech-savvy seniors are increasingly being preyed upon online. The FBI 2022 Elder Fraud Report found that seniors lost almost $1 billion to investment fraud last year.

The State of Investment Fraud Study

To help raise awareness and combat this issue, Carlson Law, an investment fraud law firm that has recovered tens of millions of dollars for victims, released their first annual study, The 2023 State of Investment Fraud, after analyzing the most recent data from the following annual fraud reports:

The rankings in this study are based on an analysis of data in all 50 states and the District of Columbia (D.C.).

Below we will break down the following:

- Parts of America where people are most at-risk for investment fraud

- Most common types of investment fraud in 2023

- How to avoid investment fraud

- Signs you are dealing with a scammer

- Tips for people to recover their lost assets once they have been defrauded

Key Findings:

- California, Most Impacted State Overall: Ranks first for total money lost ($870 million), second for average loss per victim ($176,463), and fifth for highest rate of investment fraud with 12.6 per 100,000 residents.

- D.C., Highest Rate of Investment Fraud: D.C. ranks first with 26 victim complaints filed with the FBI per 100,000 residents in 2022. Investment fraud in the “DMV” area happens frequently with Maryland ranking second (17.5 per 100,000) and Virginia No. 18 (6.7 per 100,000).

- New Hampshire, Smaller States Have Highest Losses Per Victim: New Hampshire ranks first with the average victim losing $204,447. In this category smaller states were hit hardest with Nebraska ($163,565), Wyoming ($161,472), and Kansas ($156,790) also in the top five.

Which States Lose the Most Money in Investment Scams?

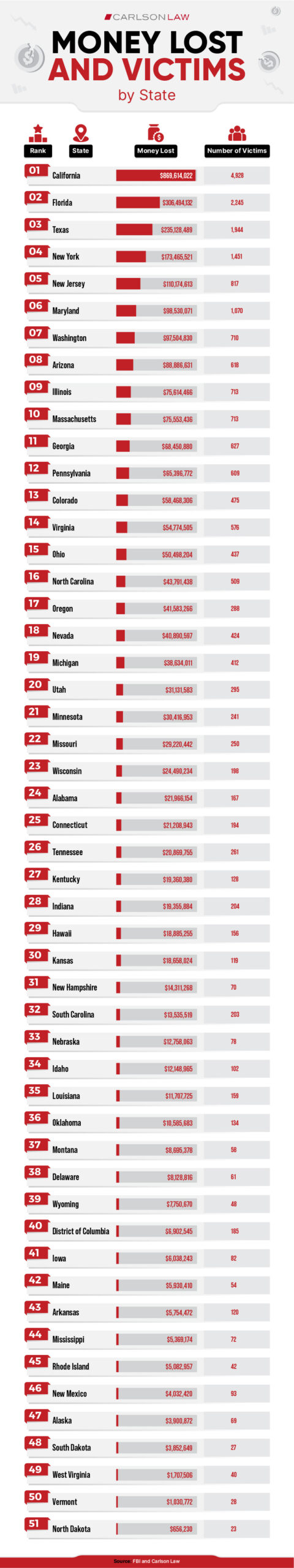

We begin by analyzing the total number of victims and money lost in each state. The most populous states rank high in this category. Beneath that, we look at two population adjusted metrics: which states have the highest rates of investment fraud and which states have the highest average loss per victim.

According to the FBI, California ranks first for money lost to investment scams in 2022 with 4,928 victims losing $869 million. Florida ranks second with 2,245 victims losing $306 million, while Texas (1,944 victims lost $235M), New York (1,451 victims lost $173M) and New Jersey (817 victims lost $110M) round out the top five.

Here we look at the rate of investment fraud per 100,000 residents. Despite this population adjusted data, many larger states remain in the top 10, such as New York, California, and Florida. This reinforces that residents of these states should remain vigilant. Three less populated states cracked the top 10, including Hawaii, Alaska, and Utah. However, investment fraud happens most frequently not in one of our states, but rather, in our nation’s capital.

D.C. ranks first with 26 victim complaints filed with the FBI per 100,000 residents in 2022. Maryland ranks second at 17.5 per 100,000, while New York (17.1 per 100,000), Nevada (13.7 per 100,000), and California (12.6 per 100,000) round out the top five.

On the other end of the spectrum, several highly populated states ranked exceptionally low for incidences of investment fraud. For example, Ohio, the seventh most populous state, ranks 40th for investment scams; while Alabama and Wisconsin rank 43rd and 44th, respectively, for rates of investment fraud despite ranking in the top 25 for population.

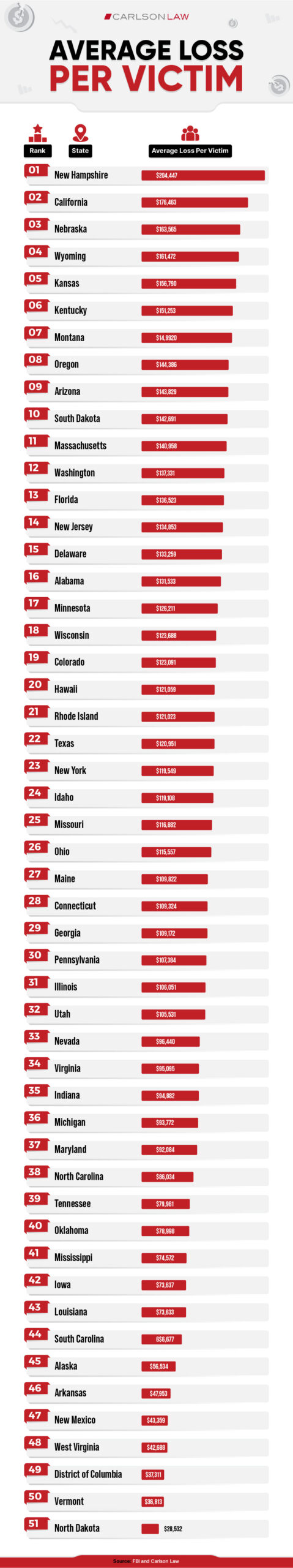

While smaller states have lower monetary losses in total due to their population, the individual victims in these smaller states tend to lose more money on average.

New Hampshire ranks first with the average victim losing $204, 447. California ranks second ($176,463), while Nebraska ($163,565), Wyoming ($161,472), and Kansas ($156,790) round out the top five.

D.C. had the third lowest losses per victim at just $37,311, despite having the highest rate of investment fraud as seen above.

- Real Estate: Fraudsters create a lucrative real estate investment opportunity that does not actually exist. This is called the “Phantom Property” scam. They advertise property listings online that are available for investors at a low price that can be flipped for quick profits. The scammers often use fake documents, such as titles, to appear legitimate and ask the investor for upfront fees for property inspection. Once the fee is paid, the scammer usually disappears.

How to Avoid: Before investing in real estate, visit the property, meet the agent in person, and thoroughly research the background of the agents involved.

- Ponzi Schemes: Ponzi schemes promise high returns on investment to attract new investors. However, the returns paid to existing investors come from the money contributed by new investors rather than from legitimate profits. Typically, no real trades or investments are ever made. Eventually, the scheme collapses when new investors can no longer be found to sustain the payouts.

How to Avoid: Be wary of any investment that offers high, consistent, or “guaranteed” returns.” Make sure the person is licensed (see below), and thoroughly research the investment opportunity. Speak to other people in the industry of the alleged investment and ask if it is possible to produce those types of returns.

- Artificial Intelligence (AI) – Voice Clone and Deep Fake: Deep fake videos look and sound as if they are someone legitimate, but they are computer generated. One woman was searching online for investment opportunities and lost $750,000 when fraudsters used a “voice clone” of billionaire Elon Musk. The fake Musk directed her to a website where she could buy shares of his stock for $250. She went to the site, invested, and received documentation showing huge returns on her investment. In fact, her money was stolen. Similar scams show a YouTube video of a “CEO” when in fact it is a “deep fake” AI generated fictitious avatar.

How to Avoid: Meet in person before investing, voice cloning can lack human inflection, and if it involves a celebrity or sounds too good to be true, it usually is.

- Cryptocurrency Initial Coin Offering (ICO) Fraud: ICOs are fundraising methods used by cryptocurrency startups to raise capital. Scammers may create fraudulent ICOs, promising high returns on investment or innovative projects that do not exist. They may use fake websites, social media promotions, and misleading whitepapers to lure investors into buying their tokens. Once they have collected a significant amount of funds, they disappear or fail to deliver on their promises.

How to Avoid: Most cryptocurrencies cannot deliver what they claim they will. Conduct background checks on the team behind the ICO and check the whitepaper for typos or other information that may not make sense or is overly optimistic.

- Pump and Dump Schemes: This type of fraud occurs primarily in the stock and cryptocurrency markets. Fraudsters artificially inflate the price (pump) of a low-volume, low-value stock or coin by spreading false information or using deceptive practices to create hype. Once the price has risen, they sell their shares at a huge profit, causing the price to crash (dump), leaving victims with losses.

How to Avoid: Be skeptical of hype and sudden spikes in asset prices. Avoid impulsive investment decisions. Check the average trading volume going back several months compared to recent trading volume to try to understand if the recent spike is simply based on a rise in volume. Speak to an expert before investing.

5 Signs It May Be a Fraud or Scam:

- Guaranteed Returns: Anything that seems too good to be true usually is. Many frauds offer guaranteed returns of more than 1% per month, sometimes even more than 10% per month. Real investments can rarely guarantee a result, and real results are typically not greater than 10% per year.

- Aggressive Sales Tactics: Avoid anyone that is too pushy, demands that you sign and invest right away, claims the investment opportunity is going away, or claims there is a waiting list but he or she can get you access.

- Not Licensed: If the person is not licensed to sell securities or give investment advice, you should not purchase investments from them. Search for licenses using FINRA’s Brokercheck and/or the SEC IARD Search. Also review the free reports on those pages for red flags.

- Will Not Provide Information in Writing: If the person will not provide information in writing or does not have the right paperwork (i.e., stocks/mutual funds must have a prospectus and bonds must have a circular), it is a red flag. All of the promises that were made to get you to invest should also be put in writing from the salesperson’s work email address. You should also have an attorney review all of the documentation.

- Will Not Meet In Person: Anyone offering a legitimate opportunity will be willing to meet you in person. If the salesperson is not willing to meet you in person and show you that they are who they say they are, do not invest with them.

5 Immediate Steps to Recover Your Lost Assets:

- Document everything: Create a file including the suspected fraudster’s name, contact information, email and text message exchanges (make sure you save the text messages or screenshot them and send them to yourself so you do not erase them by accident), website (also take as many screenshots as possible before their website is taken down), and any alleged investment documentation they provided.

- Report it immediately: As soon as you suspect fraud, report it to regulatory bodies, including the SEC, FINRA, NASAA, and the FTC. You should also consider reporting it to law enforcement—including your local police, district attorney’s office, attorney general, and the FBI.

- Hire an Attorney to Assist: You may be able to recover your funds by hiring an investment fraud attorney who can advise you on remedies, including bringing a civil lawsuit or arbitration. Many attorneys in that field are willing to work on a contingency fee basis, meaning you only pay them a fee if they are successful.

- Follow up: Unfortunately, law enforcement and government regulatory bodies may be slow to act. Follow up with them every 30 days.

- Call Your Bank: If you wired money through your bank, call your bank immediately and see if it is possible to freeze the wire or obtain information on who the actual recipient of the wire transfer was.

Conclusion

Investment fraud is currently the costliest type of fraud in America and the schemes are becoming increasingly complex as criminals fuse traditional tactics with online scams involving cryptocurrencies and artificial intelligence. The best way to avoid investment fraud is to never send money or give personal information to any entity or individual unless you have thoroughly researched their background, met them in person, and consulted with a third-party expert.