Saint Johns, Florida financial advisor Kendal Cann (CRD# 6504618) allegedly recommended unsuitable investments, according to a recent investor complaint. Financial...

Read MoreInvestment Fraud in U.S. Reaches Record Levels

-

Unprecedented $4.57 Billion Lost to Investment Scams Last Year

-

Tech-Savvy Millennials Fell for More Investment Scams Than Any Age Group

-

A record 86.7% of Losses Involved Crypto Totaling $3.96 Billion

Investment fraud is skyrocketing and has become the No. 1 costliest type of fraud in America, according to the Federal Bureau of Investigation (FBI).

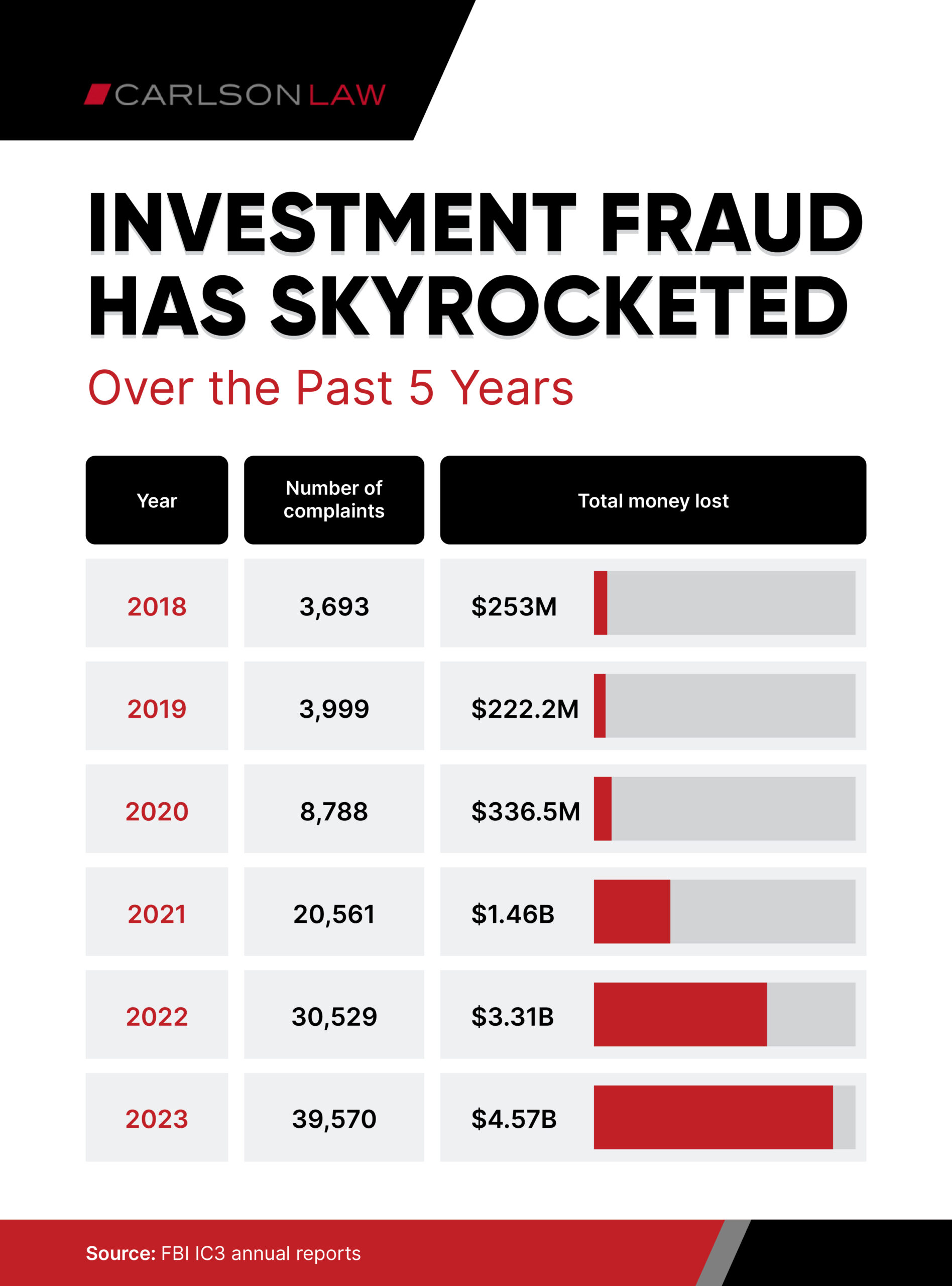

A record $4.57 billion was lost to investment fraud in 2023, up from $3.3 billion in 2022 and a staggering 18 times higher than $253 million in 2018.

Investment scams have only exploded in recent years. In 2023, the total number of investment fraud victims was 11 times higher than five years ago, with complaints rising from 3,693 in 2018 to 39,570 last year. The average loss per victim was a staggering $115,499, up from $68,496 in 2018.

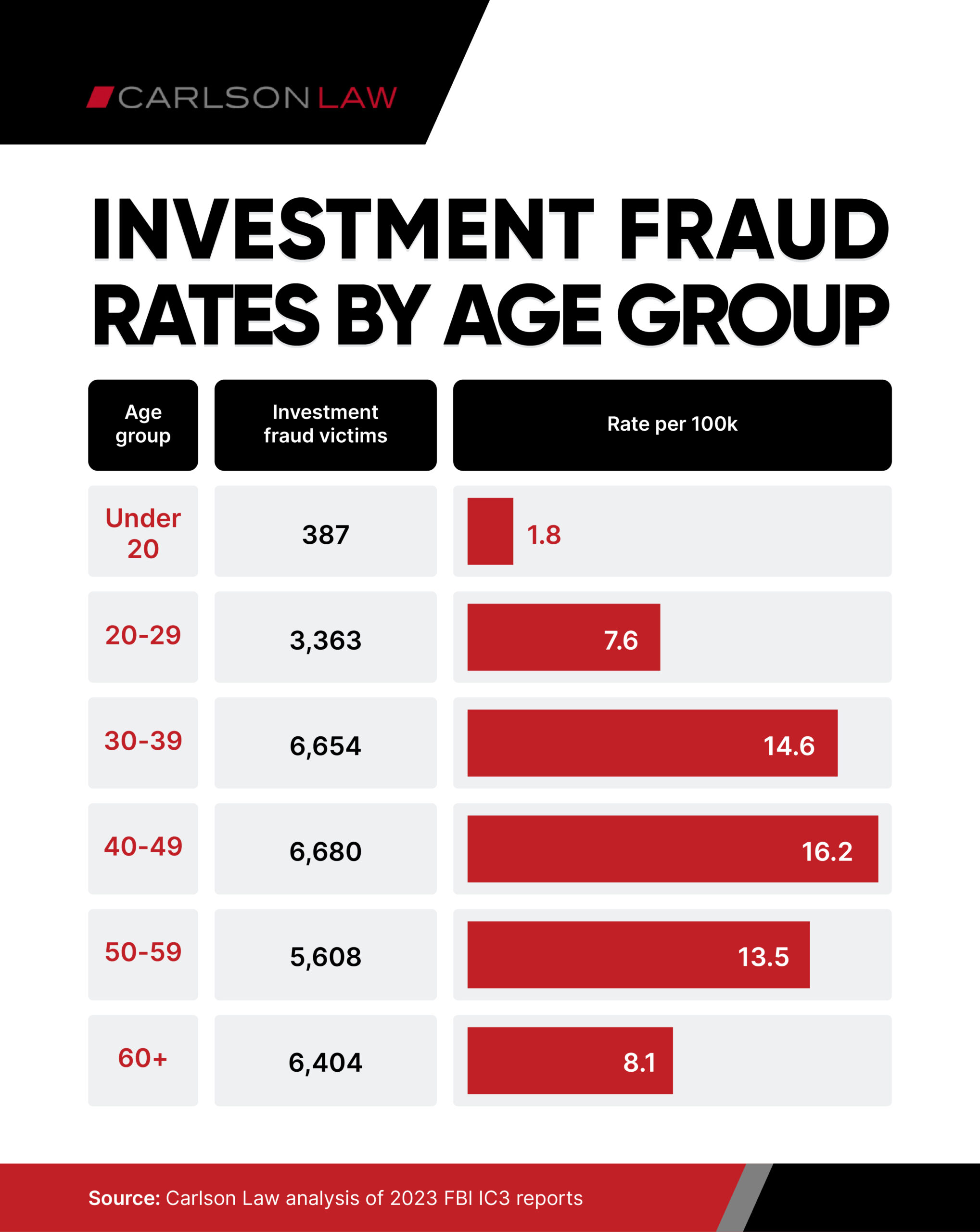

For all their tech prowess, millennials had more investment fraud victims than any other generation last year, followed by Gen X. About two in three investment fraud victims were in their 30s to 50s, while 12.9% were in their 20s or younger and 22% were 60 and up.

Fraudsters are using creative ruses to lure people in on social media, dating apps and networking sites, which makes younger people particularly vulnerable.

Not surprisingly, millennials are also the most likely age group to trade cryptocurrency, according to an investing study conducted by The Motley Fool.

A record 86.7% of all money lost in 2023 involved crypto – totaling $3.96 billion. Scammers promise lucrative returns on low-risk investments – and then disappear with the money, or send fake reports to get people to keep investing.

Fraudsters have also become adept at using crypto in romance scams by entering fake romantic relationships with their targets, usually via online dating platforms, social media, or messaging apps, with the ultimate goal of convincing the victim to invest in fraudulent cryptocurrency schemes – a practice commonly known as “pig butchering.”

Many people have lost their life savings to crypto scams. In one case, a father from Virginia committed suicide after losing his life savings after investing in crypto as part of a romance scam.

While classic forms of investment fraud are still common – including advance-fee scams, Ponzi or pyramid schemes, market manipulation and real estate investing scams – Legendary investor Warren Buffett said recently that AI’s use in scams is going to be the biggest “growth industry of all time.”

We have already seen fraudsters using AI to impersonate celebrities and business leaders in videos using voice cloning technology to encourage people to invest. As AI exponentially improves, it will become the No. 1 challenge facing law enforcement when it comes to online safety.

Carlson Law, an investment fraud law firm that has recovered tens of millions of dollars for victims, is releasing this study after analyzing data from the FBI’s Internet Crime Complaint Center from 2018 to 2023.

Key Findings

- Investment Fraud is the No. 1 Costliest Fraud in U.S.: A record $4.57 billion was lost to investment fraud in 2023, up from $3.3 billion in 2022 and a staggering 18 times higher than $253 million in 2018.

- Tech-Savvy Millennials are the No. 1 Most-Scammed Generation: Millennials had more investment fraud victims than any other generation last year, followed by Gen X. About two in three investment fraud victims were in their 30s to 50s, while 12.9% were 29 and younger and 22% were 60 and up.

- Crypto Accounted for a Record 86.7% of Total Losses: One reason Millennials are the most-scammed generation is because investment scam losses involving crypto reached a record $3.96 billion in 2023.

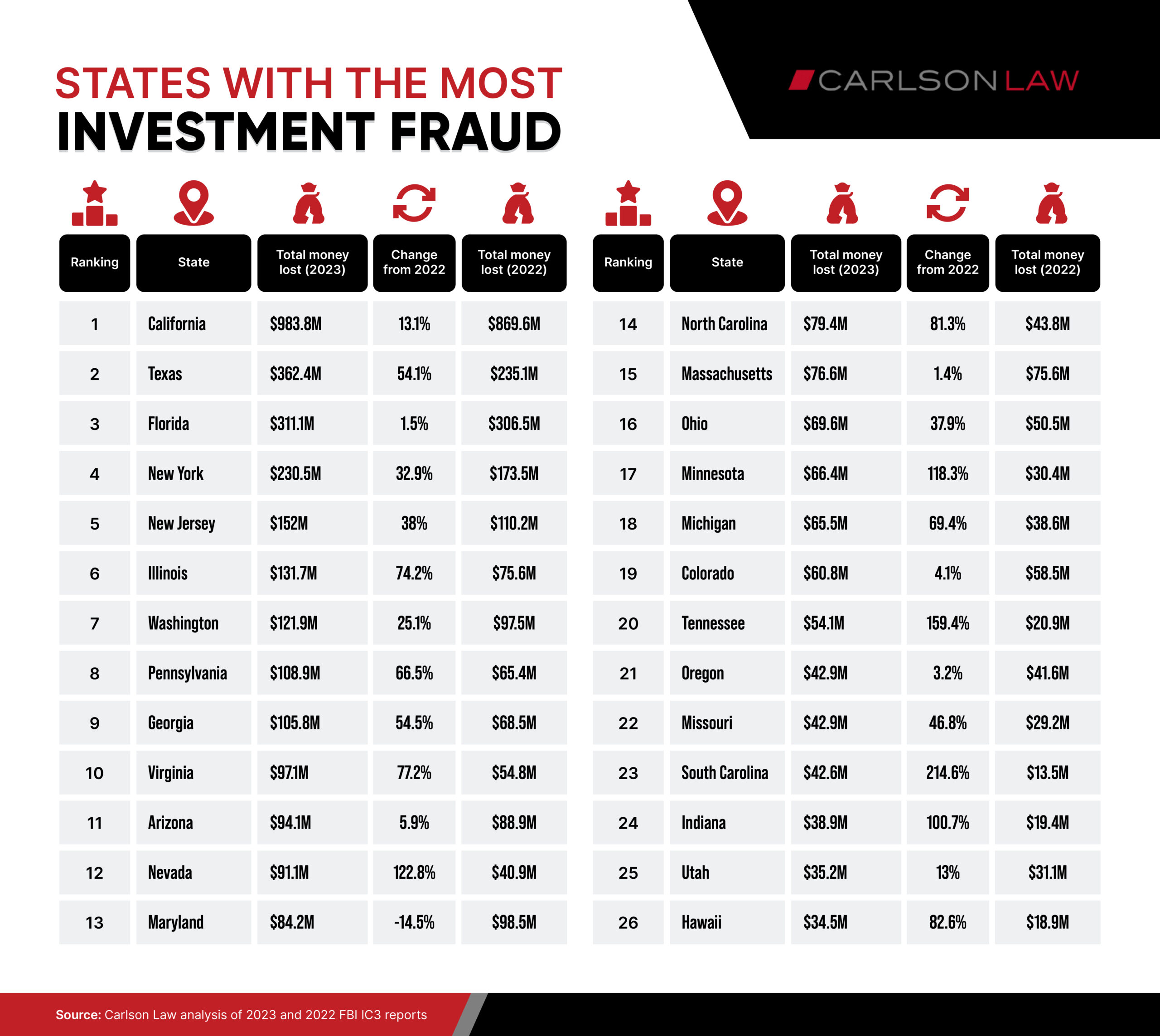

- California Is the Worst State for Investment Fraud. All together, Californians lost $983.8 million to investment fraud in 2023, up 13.1% from 2022. It also has the country’s second-highest fraud rate, with 13.7 victims per 100,000, and an average loss of $183,856.

- Maine Has the Least Investment Fraud. Maine residents lost a collective $2.5 million in 2023, lower than any other state. In addition, unlike most states, the state actually saw a 58.5% decrease in total losses from 2022. Victims in Maine lost an average of $50,199.

- Fraud Is Surging Even in Less Hard-Hit States Overall. In five states, total investment fraud losses were at least three times higher in 2023 than they were in 2022: North Dakota (8.6x higher), New Mexico (4.7x), Montana (3.7x), Vermont (3.5x) and South Carolina (3.1x).

Interactive Map: Click on your state to see where it ranks

Where Americans Lose the Most Money in Investment Scams

California residents lost a collective $983.8 million to investment fraud in 2023 – nearly three times as high as the runner-up state, Texas, where residents lost $362.4 million. Florida ($311.1 million), New York ($230.5 million) and New Jersey ($152) rounded out the top five. Naturally, the most populous states tend to rank higher in this category.

California may not be No. 1 for long, however. While the Golden State saw a 13.1% increase in total loss compared with 2022, losses grew at a much faster rate in other states. No. 6 Illinois, for example, experienced 74.2% year-over year growth. Among the states with the most investment fraud loss, only Florida saw a relatively flat rate, increasing just 1.5% between 2022 and 2023.

On the other side of the spectrum, smaller states reported less investment fraud loss overall, led by Maine ($2.5 million), Vermont ($3.6 million), West Virginia ($3.7 million), the District of Columbia ($4.8 million) and Delaware ($5.1 million).

Even so, states with low levels of investment fraud loss are on the same upward trajectory as the rest of the country. For example, while North Dakota had one of the lowest total losses in 2023 ($5.66 million), that amount surged from $656,230 the year before – the biggest increase of any state by far.

In fact, just nine states saw a decline in total investment fraud losses between 2022 and 2023: New Hampshire (60.4% decline), Maine (58.5%), Delaware (37.8%), Nebraska (33.9%), the District of Columbia (31.2%), Kentucky (29.8%), Wyoming (26.1%), Maryland (14.5%) and Kansas (11%).

Where Investment Fraud Rates are Highest

Americans in some states are more susceptible to schemes than others. Maryland had the highest rate of investment fraud, with 14.4 victims per 100,000 residents, followed by California (13.7), Hawaii (13.6), Nevada (13.4) and Florida (12). These states tended to have more fraud victims overall – except Hawaii and Nevada, which have disproportionately high rates relative to their populations.

Conversely, the states with the lowest fraud victim rates are Vermont (3.4), Maine (3.5), West Virginia (3.8), Mississippi (3.8) and Iowa (3.9). These states had fewer than 150 victims each in 2023.

What the Average Victim Loses in Investment Scams

Americans who fell victim to investment scams lost a staggering average of $115,499 in 2023, up 68.6% from five years earlier. That level varied across the U.S., with the highest average losses in Montana ($370,164), Nevada ($213,899), California ($183,856), Hawaii ($175,919) and New Jersey ($164,548).

Meanwhile victims lost the least, on average, in Maine ($50,199), West Virginia ($54,602), Delaware ($62,441), Nebraska ($72,716) and Kentucky ($75,097).

A Closer Look At Senior Investment Fraud

Seniors, who tend to have more money than Millennials, had the most to lose, though, getting swindled out of a record $1.2 billion to investment scams last year, up from $990 million in 2022.

Seniors filed 6,443 investment scam reports with the FBI last year, an 11-fold increase from 583 reports in 2018.

Overall, the number of adults ages 60+ who fall prey to investment fraud has surged in the past five years, from 583 complaints in 2018 to 6,443 in 2023 – 11-fold higher, according to the FBI’s IC3 Elder Fraud Reports. Like the overall spike in investment schemes, most of this uptick is due to an increase in crypto-related scams.

There’s also wide variation at the state level, with seniors in some parts of the country more susceptible to investment fraud than others. The five states with the highest rates – measured as the number of senior victims per 100,000 – are Hawaii (15.5), California (13.7), Utah (12.4), Arizona (12.2) and Alaska (11.7).

On the flip side, the states with the savviest seniors are Maine (1.7 victims per 100,000), Iowa (2.5), West Virginia (2.8) and Mississippi (3.2). Another four states – Alabama, Indiana, Wisconsin and Kansas – tied for the fifth slot, each with 3.8 victims per 100,000.

5 Common Types of Investment Fraud in 2024 – And How to Avoid Them

- Crypto: Crypto scams are particularly appealing to fraudsters because transfers are irreversible, payments are not protected by the government and there is no central authority or bank to flag suspicious activity. The FTC says if you hear from an investment manager who guarantees returns on a crypto investment, a celebrity who offers to double your money or an online love interest wants to go in on a crypto investment together – they are likely fake. Do not engage or invest.

- Artificial intelligence: Fraudsters are exploiting the hype around AI and other new technologies to trick people into investing in nonexistent businesses. They can also use AI to impersonate CEOs, SEC officials, and even family and friends. Make sure to review several sources and verify your communication is legitimate before investing.

- Social media: With the amount of personal information people now put online, it is easier than ever for scammers to strike up relationships using tailor-made personas based on victims’ lifestyles, hobbies, interests and more. Con artists can become part of an online community and make targeted investment pitches based on the trust they’ve built. Never invest with people you have not met in person.

- Real estate: Thieves will push real estate investments as a more lucrative alternative to traditional retirement planning. Keep an eye out for borrowers who want to finance property investments through other means than traditional loans, or those who ask you to fund a property flip. Scammers may be misrepresenting the value of the property or using your name and information to facilitate other schemes.

- Ponzi schemes: In a Ponzi scheme, the con artist will promise that if you invest now, they will pay you massive returns on profits from their business, or that you will earn by recruiting more people into the business – but the underlying claims or products are entirely fake. Avoid them by carefully assessing the investment terms and conditions, and making sure whatever you are investing in is real.

How to Protect Yourself Against Investment Fraud

Regardless of the type of investment scam, you can protect yourself with these three tips:

- Do your research. Verify information about the investment and the people involved with official sources, and make sure you understand the risks involved before investing.

- Be skeptical and take your time. If an opportunity seems too good to be true, it probably is. Scammers often try to build their victims’ trust and then create high-pressure scenarios to get people to invest immediately, before they’ve had time to think it through. Sound investments usually have no short time period to invest.

- Get professionals involved. Ask a trusted financial advisor about the opportunity if you are not sure about its legitimacy. Friends and family can help, but they are also at risk of getting scammed.

- Check Licenses. Make sure financial advisors or investment advisors are licensed either through FINRA or the SEC.

- Be skeptical of high returns. As a general back of the envelope math rule of thumb, any investment that promises greater than 10 or 12% annual returns is probably too good to be true or extraordinarily risky. Safe investments typically pay returns of nearly half those rates.

How to Recover Your Lost Assets

If you think you have been scammed, take the following steps right away.

- Call your bank. If you wired money through your bank, call them immediately and see if they can freeze the transfer or get information on the recipient.

- Document everything. Create a file including the suspected fraudster’s name and contact information, screenshots of your email and text message exchanges, screenshots of their website – it may get taken down – and any alleged investment documentation they provided.

- Report the scam immediately. As soon as you suspect fraud, report it to regulatory bodies, including the SEC, FINRA, NASAA, and the FTC. You should also consider reporting it to law enforcement, including your local police, district attorney’s office, attorney general and the FBI.

- Hire an attorney. An investment fraud attorney can advise you on potential remedies to recover your money, including bringing a civil lawsuit or arbitration. Many attorneys are willing to work on a contingency fee basis, meaning you only pay them a fee if they are successful.

- Follow up. Law enforcement and government regulatory bodies can be slow to act, so follow up with them every 30 days to ensure your case does not fall by the wayside.

Conclusion

Investment fraud affects people across the U.S., regardless of their age or location. Carlson Law has represented investors all over the country, from all age groups, and with all different backgrounds, including professional athletes, entertainers, doctors, lawyers, entrepreneurs, and widows. It is important to stay vigilant when it comes to investing and to seeking guidance from trusted financial and legal experts. With con artists taking advantage of new technologies and getting more creative than ever with their schemes, doing your research and seeking professional advice can help you safeguard your financial well-being.